Company name:

DRAGON 2000

Deal Type

Sale

Country

United Kingdom

Buyer Name

Lacour Group

Country of Buyer

France

Sectors

Automotive & Technology

1 Reply:

Cooper Parry Corporate Finance advise business owners who want to sell their business or grow their business through private equity investment.

Cooper Parry Corporate Finance advise business owners who want to sell their business or grow their business through private equity investment. Our UK team is supported by Reach Cross-Border Mergers and Acquisitions, a highly active international network of partner firms, working closely with investment banks and corporate finance boutiques across 30 key deal-making countries to find buyers that others can’t.

Selling your business is a huge event. Financially and emotionally. So, you need to work with the right advisor – one who can find the best buyer for the enormous value you’ve created, at the best price.

You need a team of advisors who really understand your industry’s buyers, value drivers and market opportunities, as well as having masses of experience in getting deals across the line.

We’ll lead your business through a sale, making sure it’s as smooth as possible, so you can continue running your business and hitting targets throughout the process.

If you’re looking for investment, our team will help you select the right private equity investor for you, your business, and your sector. We’ll negotiate the best terms and then facilitate the relationship between you and your preferred funding partner. We also have masses of experience in advising management buy-out teams.

Our Deal Origination team is an ever-growing, ever-important part of Cooper Parry Corporate Finance too. They connect us with great businesses in sectors where our expertise lie, analysing trends, creating and providing relevant and insightful market and deal information.

We’d love to meet you and your business well in advance of any transaction. That way, you can get the best possible outcome for your shareholders, your team, and your business.

Company name:

Deal Type

Sale

Country

United Kingdom

Buyer Name

Lacour Group

Country of Buyer

France

Sectors

Automotive & Technology

Company name:

Deal Type

Sell Side Lead Advisory

Country

United Kingdom

Buyer Name

Steer Automotive Group

Country of Buyer

United Kingdom

Sectors

Industrials

Company name:

Deal Type

Company Sale

Country

United Kingdom

Buyer Name

A J Gallagher Inc

Country of Buyer

USA (via UK subsidiary)

Sectors

Business Services

Let’s talk today

Want us to call you? Let’s start a conversation!

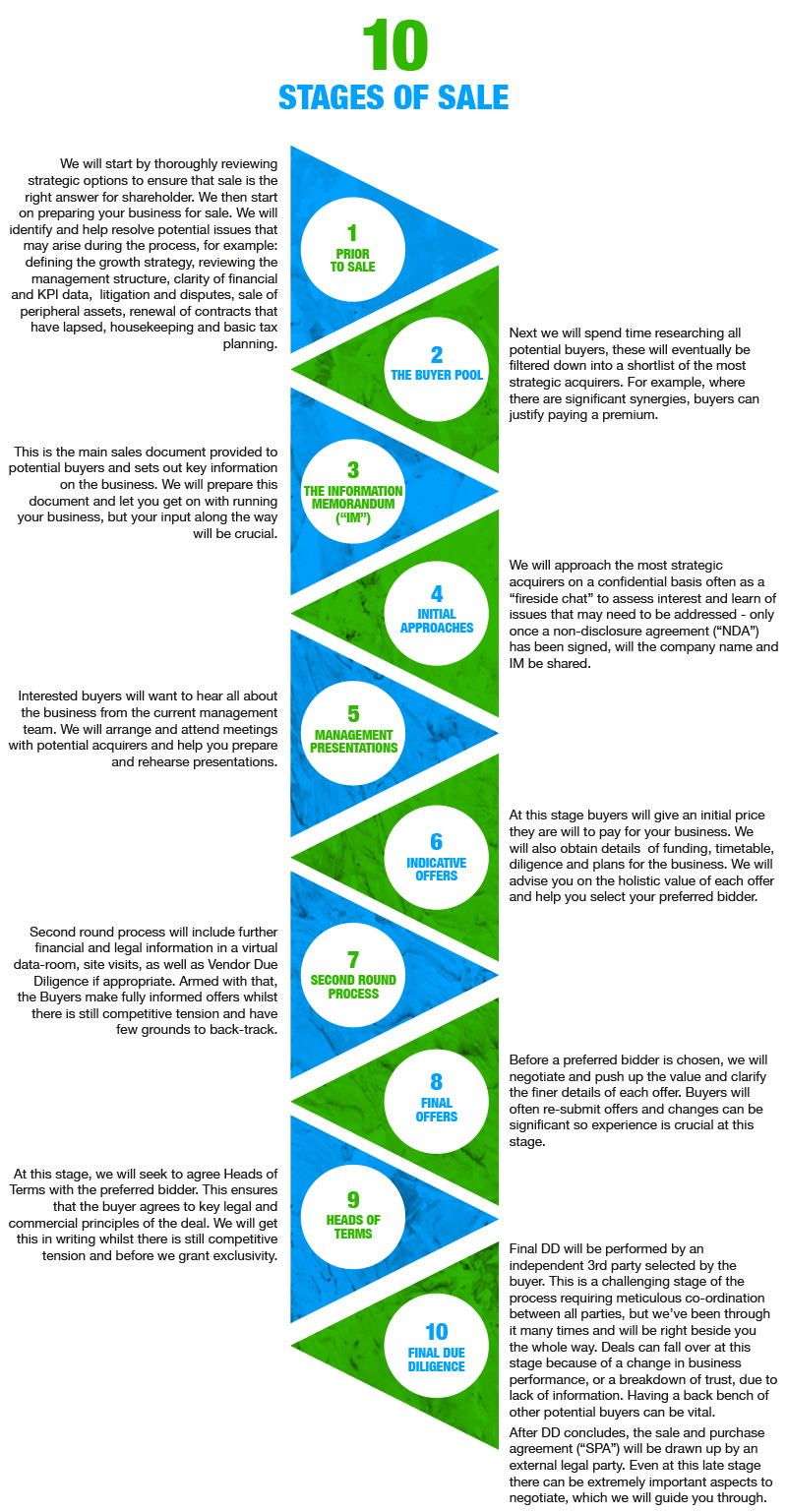

Our deal specialists are well versed on every step of the sales process. Here are the ten key stages from preparations prior to sale through to final due diligence.

The world of investment can be complex. Our deal experts know every twist and turn. On these pages they highlight the ten key stages from understanding a client’s needs through to joyous completion.

“This year has not been the easiest audit from my side due to changes in FMC, but the team have been very patient with me getting all the data back and even Nicola has taken her laptop on holiday to hep us get the accounts across the line before the deadline of 30.09 as my Corporate line manager was not keen to extend the deadline. I cant thanks Nicola enough for doing this, it has certainly made my life a lot easier!”

“Very supportive as we have brought the audit forward this year. Technical guidance is relevant and timely. Tax support well rounded across all relevant areas.”

“Good communication, timely input, available when we need you..”

“We have been going through a difficult period at the school which made our 2023 audit very challenging. The team at Cooper Parry showed a high level of empathy and understanding and worked with us to help facilitate a smooth audit process which we are very grateful for. They have continued to offer support throughout the year following offering advise and alleviating any concerns that we have had regarding the financial impact of the school’s situation. We would highly recommend them.”

“Great communication, audit timetable agreed and stuck to. Issues flagged early. Great technical support if we have questions through the year.”

“Happy with the level of communication, which is sometimes difficult to get right.”

“I really like the inflo management system, it makes dealing with requests very easy and ensures that data is transferred securely. I like the visual details on the dashboard section to show how the audit is progressing.”

“Very smooth audit, auditors and team very approachable and very helpful. Responses in timely manner, we also do our best and reply asap so I think this works for both parties so keep the audit flowing. I like the Info portal, it’s great working on it, wish we could implement something similar in our place.”

“From planning to completion of the audit and the presentation at our AGM the service and quality of work provided was outstanding.”

“The management letter that you produce is the outstanding item of the work that you undertake as it clearly sets out to our Directors in lay English our financial accounts.”