Are You Ready for HMRC’s new RDEC Regime?

Mark Frost

6 minute read

1 Reply:

We can help you join the dots and access funding and investment before starting on your R&D journey.

Research & Development (R&D) incentives claims are a core part of the support the CP Innovation team offer companies. Take a look at the information below which will tell you more about R&D incentives and the potential benefits for your company. Then talk to us.

The R&D tax incentives regimes have been designed to incentivise companies incurring costs undertaking scientifically or technologically challenging projects. It is called “R&D” but the sort of projects which can qualify are much broader.

R&D for tax purposes occurs when businesses actively develop new products and processes OR “appreciably improve” existing ones. It helps businesses remain competitive in their marketplace, whilst striving to push the boundaries of what can currently be achieved in their industry. However, we’ve found “R&D” is a bit of a red herring. Taken at traditional face value it sets the bar in the wrong place in people’s minds about what qualifies and what doesn’t.

We remove the misconceptions. And we’ll show you there’s a lot more to R&D incentives than just brand-new blue-sky research and thinking (usually associated with the likes of rocket science and pharma).

Put simply, it comes down to two things, CHANGE and CHALLENGE:

So, if you’ve made changes that took some thought and sleepless nights – it’s time for us to talk.

Let’s talk today

Want us to call you? Let’s start a conversation!

This is the package of financial support provided to UK businesses by the Government via the tax system to encourage R&D activities. In other words, a mechanism by which to reward companies for the development of new or improved products, processes, and services.

The CP Innovation team is experienced in working with companies to make sure they’re providing the information HMRC needs. Our reputation is based on the quality of our submissions, providing HMRC with what they need to make a positive assessment of your incentives claims. We will also tell you if we don’t think your claim will be successful based on current HMRC guidance!

We’ve worked on R&D tax credits and incentives since it all started in 2000. And our Tax Partner Chris Knott is involved in multiple Working Practice Groups seeking to raise standards in the R&D incentives claims industry. Specialising in technical areas such as Engineering and Manufacturing (everything from automotive to aerospace, chemical to nuclear), Food & beverage, IT, Pharmacology and Chemistry. So, when it comes to your business, whatever the industry, we know what we need to find. We have a proven ‘CP way’ of doing claims that works. Our experience means we understand what exactly can be claimed and what red flags to avoid.

Over recent years there has been abuse of the R&D tax regime by unscrupulous advisors. HMRC increasingly carry out compliance checks and it can be challenging and time-consuming to get claims approved by them. We’re confident in our approach and we’ll be by your side from start to finish.

Your business has fewer than 500 employees and either less than €100 million turnover or €86 million gross balance sheet assets. This is measured on a global group basis, so if your business is part of a group, or connected to other businesses (as a linked or partner enterprise – we can advise on these), you may need to consider their financials (or a portion of them) as well.

If your company is not eligible to claim under the SME criteria mentioned above, you may be in a position to claim under the large company scheme. This is also known as the R&D Expenditure Credit (‘RDEC’).

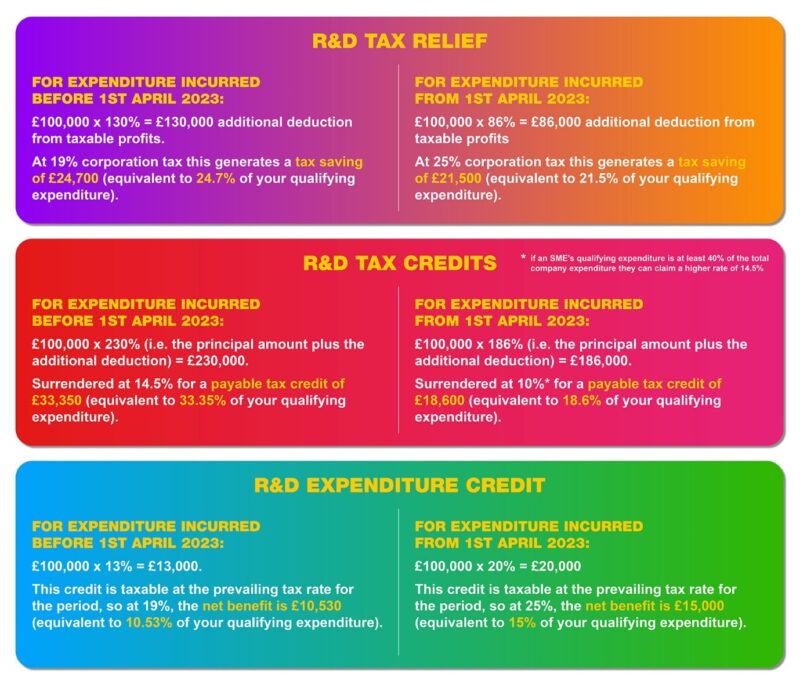

There are three types of incentives available, and each one has a specific name. If you hear anything else, it will likely be a collective name for some or all of the below:

This is the additional deduction from taxable profits available for profit-making SMEs.

This is the payable tax credit available for loss-making SMEs.

This is the payable credit (RDEC) available for all claimants under the Large company regime.

The amount that your business receives depends on two factors: (i) the type of relief claimed (R&D tax relief, R&D tax credits or RDEC); and (ii) the amount of qualifying R&D expenditure.

As an illustration, for £100,000 of qualifying R&D expenditure, the benefit under each incentive is as follows:

We’re committed to ensuring that you submit a good quality, realistic claim. We’ll tell you if we don’t think your claim will be successful before you start the process (or if that becomes apparent further into the claim process). We’re experienced in providing HMRC with what they need, based on years of experience from across a variety of industries.

We work on a fixed fee basis which means you’ll know exactly how much submitting a claim will cost you. If HMRC does decide to carry out a ‘compliance check’ on your claim, we’ll be by your side to help you through it.

You might consider R&D tax incentives claims to be onerous and painstakingly slow. But with our experience, approach and relationship with HMRC, we have a slick process for getting claims submitted and processed. We’ll also keep you informed along the way. And we love visiting clients – their workshops, factories and offices. We’ll show you exactly what you can claim in real-time, and in good time. No one has a Tardis, so why are people turning this into a memory exercise by leaving claims so late to prepare?!

Fancy showing us around? Let’s put some time into getting to know your business.

“Prompt service.”

“Clear and concise advice from Candice. 5 Stars!”

“Great clear concise service.”

“Efficient, friendly service “

“Although new clients to Cooper Parry therefore the audit took longer than we would like, Tara, Steph and their team have been very good in onboarding us and guiding us through it. Communication has been good between us and CP, and we have now worked out a schedule for the 2024 accounts audit which should mean it will be completed earlier.”

“Good team, very responsive.”

“Pragmatic on audit approach, supportive on working through technical areas and overall managed to achieve the deadline. Areas of improvement would be communication to ensure we are all aligned on work requirements, deadlines to work around holidays etc. and where each entity is up to in the audit process so we feel assured we are on track.”

“The audit was well run with a pragmatic approach where needed. The presentation of the results was also well managed. “

“Regarding the audit process, we found no specific areas requiring improvement. Throughout the audit, the regular calls and discussions proved highly productive, with responses that were clear, concise, and any queries were resolved promptly. There was continuity within the team with Steph and Hannah who were approachable. There were no instances of duplicated information that would necessitate additional work to be undertaken. Completed by the Plan Secretary on behalf of / with collaboration from the Trustee. “

“Very quick and efficient in responses and extremely effective in dealing we have had so far.”