ENGINEERING

Engineering industries continue to advance their existing engineering techniques and this lends itself to R&D tax reliefs.

If you operate an engineering business and you’ve recently developed new or improved products or processes, then there is a strong chance that you could benefit from a Research and Development (R&D) Tax Credit claim.

Full of exciting innovation, UK Engineering is becoming ever-more competitive as projects are becoming more and more complex and the need for increased efficiency and adapting to change are more important than ever.

Investing in R&D can help pave the way in creating new things or improve existing ones by looking at ways in which you can claim up to 33.35% cashback on qualifying R&D spend.

ENGINEERING SECTORS

R&D TAX CREDITS FOR ENGINEERING EXPLAINED

R&D can relate to the development of products or processes. It’s inevitable that all engineering sectors continue to advance their existing engineering techniques. And if this advancement involves a level of head-scratching and problem solving to overcome a series of technical difficulties (as it often does), it’s likely that the project will qualify for R&D incentives.

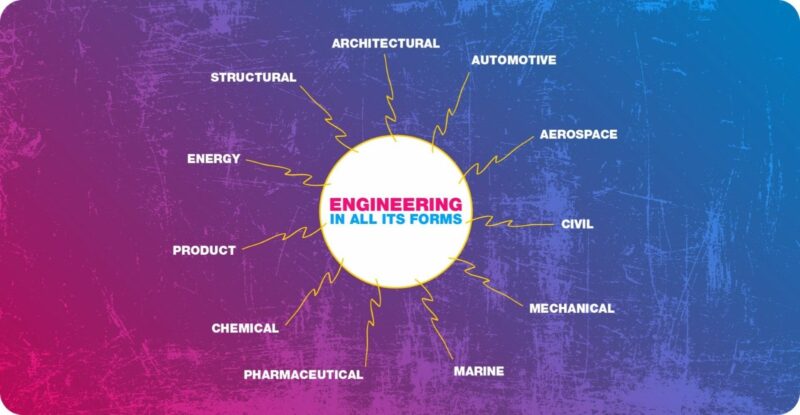

WHAT TYPE OF ENGINEERING PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

A broad range of engineering projects can meet the Government’s R&D definition, for example:

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN ENGINEERING INDUSTRIES?

We’ve spoken to hundreds of engineering businesses that think they don’t qualify for the relief, which makes the eureka moment all the sweeter.

That’s because R&D boils down to two qualifying criteria. Firstly, have you made a change or an improvement to a product or your engineering process? And secondly, did those changes take some time, some thought or some testing? Maybe there were changes made during the physical and digital design work stage? Or during the computer modeling stage.

If you can answer “yes” to both of those questions, it’s time for us to have a chat, because R&D tax incentives are a fantastic way to keep your business and your cash flow on the front foot.

WHY COOPER PARRY?

In three years we’ve put more than £61 million back with businesses. We’ve obtained in excess of £3 million for companies that had already claimed. And we’re a member of the government’s Research and Development Consultative Committee,

Our Research and Development Partner, Chris Knott CTA BEng, is a dedicated R&D incentives engineer specialist who used to work in the engineering industry. To get the report right and justify the incentives, we need to understand what you’re doing from 1) a technical perspective, and 2) who’s doing what and why it matters. So, you absolutely need to work with advisers with technical backgrounds. It means when we come to see you and have a look around your business, we can poke around in all the dirty corners. We know where to look.

WORDS FROM TRANSVAC

“We’ve worked with Cooper Parry for many years and we’ve always had a good relationship with them. The R&D arm within Cooper Parry has changed, for the better, giving us even further benefit from the tax credits perspective, and giving us improved knowledge that we can apply going forward. The transparency and willingness to share information has been great.

We received improved tax credits for two years’ worth of information provided, once the team’s expert knowledge had been applied – money that we’ll be putting back into R&D. The reports provided were concise and professional. We’d definitely recommend Cooper Parry.” – Transvac

Latest News

Reviews

STEPHEN, APR 24

“Team efficiently led by Zahib under the tutorage of Katie, focusing on the key issues early, rather than the routine chaf, whilst working effectively with our central team and local teams. NED’s like the comms, telling us the issues rather than maybe other advisors telling us how wonderful they are. I’ve just about got used to the colour scheme 😉 . Already recommended CP – says it all!”

JAMES, APR 24

“Good communication, proactive team.”

NATALIE, APR 24

“Extremely professional and pragmatic – a breath of fresh air.”

SARAH, APR 24

“Excellent delivery.”

MATTHEW, APR 24

“Efficient and personable service with a good understanding of our business.”

SCOTT, APR 24

“Well planned audit, good communication and team on site showed a great understanding of the business.”

CARL, APR 24

“We have excellent access to our audit partner. The audit team are professional and the assignment is well ran and to time. The quality of reports is great and everyone likes the way they are presented. We have tapped into other advisory services and found the support and advice excellent. Can’t think of any improvements needed.”

AMY, APR 24

“Easy to work with, responsive and to the point.”

JEREMY, APR 24

“Great service, competent and low maintenance (in a nice way!).”

MICHAEL, APR 24

“Very smooth audit, and turned round very quickly. Thank you!”