RESEARCH & DEVELOPMENT SOFTWARE

If you operate a technology or software business and you’ve recently developed new or improved products or processes, then there is a strong chance that you could benefit from a Research and Development Tax Credit.

With the pace at which the world of software development moves, and the complexity of the different jargon used, it was perhaps destined to be one of the trickiest areas for R&D incentives advisers to tackle when it comes to identifying R&D tax relief opportunities.

And they’re not the only ones that have been left confused by the R&D guidelines. HMRC themselves have drafted in their IT gurus to help their own specialist R&D incentives inspectors to ensure they stay up to speed on the industry’s advances and the IT gurus have also been helping to review claims.

Almost every business will be doing some sort of activity that meets the criteria for claiming the incentives. But sadly, a lot of these businesses are missing out, either completely by making no claim at all, or in part, by not including everything they can. And with up to 33.35% cashback available on qualifying R&D spend, that’s criminal!

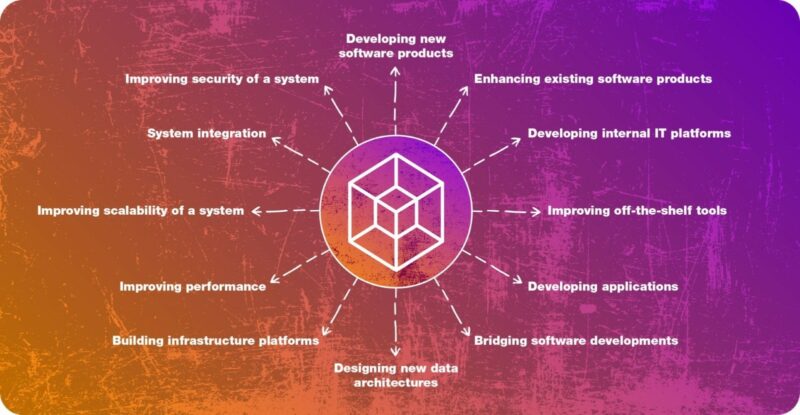

WHAT TYPE OF SOFTWARE DEVELOPMENT PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

The key parts of your projects to consider in respect of whether you will qualify for R&D incentives include:

SOFTWARE

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN SOFTWARE INDUSTRIES?

It’s essential that businesses within the software industry are driven by innovation to ensure they are remaining competitive in their ever-changing world. Developing new products, or improving existing ones, is a vital part of any software company’s operation. We’ve spoken to hundreds of software businesses that think they don’t qualify for the relief, which makes the eureka moment all the sweeter when we show them how they can.

That’s because R&D boils down to two qualifying criteria. In very straightforward terms, you should be looking at R&D closely if 1) You’ve CHANGED something (anything) in terms of what you make, how you make it, or you’ve added to your technical knowledge pool; AND 2) There have been CHALLENGES in order to make those changes work, i.e. it’s taken some thought, some time and some testing.

WHY COOPER PARRY?

In three years we’ve put more than £61 million back with businesses. We’ve obtained in excess of £3 million for companies that had already claimed. And we’re a member of the government’s Research and Development Consultative Committee.

Our Research and Development Partner, Mark Frost, is a dedicated R&D incentives specialist who specialises in software. Not only does he understand the R&D legislation but he also understands the technical jargon that can help identify the elements of your projects that qualify for R&D incentives.

Let’s talk today

Want us to call you? Let’s start a conversation!

Get in touch with Mark Frost

Latest News

Reviews

ROBERT, DEC 24

“Prompt service.”

JACK, DEC 24

“Clear and concise advice from Candice. 5 Stars!”

JACK, DEC 24

“Great clear concise service.”

JUDITH, DEC 24

“Efficient, friendly service “

LIZ, DEC 24

“Although new clients to Cooper Parry therefore the audit took longer than we would like, Tara, Steph and their team have been very good in onboarding us and guiding us through it. Communication has been good between us and CP, and we have now worked out a schedule for the 2024 accounts audit which should mean it will be completed earlier.”

CHRIS, DEC 24

“Good team, very responsive.”

PHIL, DEC 24

“Pragmatic on audit approach, supportive on working through technical areas and overall managed to achieve the deadline. Areas of improvement would be communication to ensure we are all aligned on work requirements, deadlines to work around holidays etc. and where each entity is up to in the audit process so we feel assured we are on track.”

HETAL, DEC 24

“The audit was well run with a pragmatic approach where needed. The presentation of the results was also well managed. “

JAMES, DEC 24

“Regarding the audit process, we found no specific areas requiring improvement. Throughout the audit, the regular calls and discussions proved highly productive, with responses that were clear, concise, and any queries were resolved promptly. There was continuity within the team with Steph and Hannah who were approachable. There were no instances of duplicated information that would necessitate additional work to be undertaken. Completed by the Plan Secretary on behalf of / with collaboration from the Trustee. “

PETE, DEC 24

“Very quick and efficient in responses and extremely effective in dealing we have had so far.”