RESEARCH & DEVELOPMENT FOOD AND BEVERAGE

If your business has been focusing on improvements to flavours, shelf life, and nutrition, it’s likely that you’ll qualify for R&D incentives relief.

If you’re a food or beverage manufacturer and you’ve recently developed new products, improved existing ones, or even enhanced your packaging – there is a strong chance that you could benefit from a Research and Development (R&D) Tax Credit claim or you could receive more than you’ve already claimed for.

The food and drinks industry never stands still and companies are continually looking to enhance their products. Whether it be ensuring that they keep up with the latest customer trends, deliver foods that taste great, or developing sustainable packaging that keeps food pristine, there is always a project to keep the New Product Development (NPD) teams busy.

Investing in R&D can help you create new products or improve existing ones by looking at ways in which you can claim up to 33.35% cashback on qualifying R&D spend.

R&D TAX CREDITS FOR THE FOOD AND BEVERAGE INDUSTRY EXPLAINED

The UK government wants to reward and fuel research and development in the food industry. If your business has been focusing on new product development, including improvements to flavours, shelf life, and nutrition, it’s likely that you’ll qualify for R&D incentives relief.

With so much news in the press about increased obesity rates and changes in legislation to sugar content, now is a great time to receive cash incentives to make improvements to your existing product range.

Further developments may also be eligible for R&D incentives.

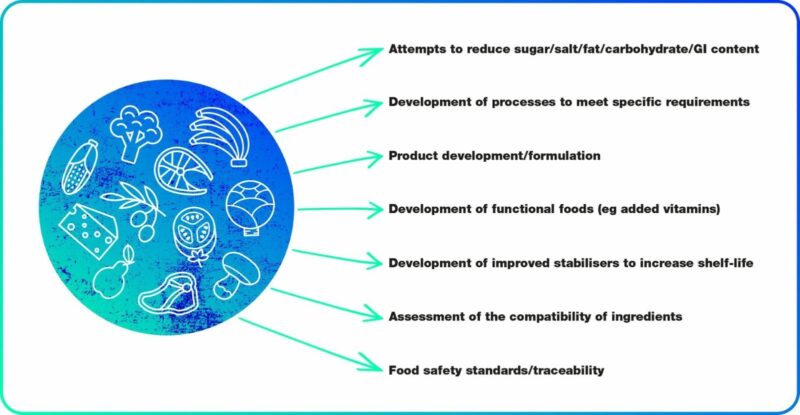

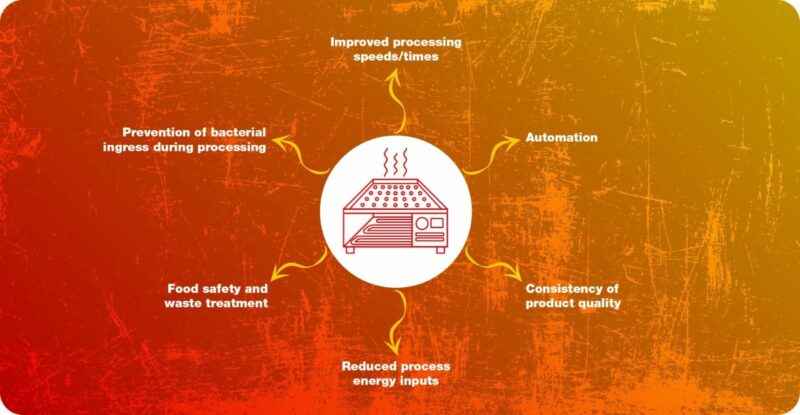

WHAT TYPE OF FOOD AND BEVERAGE PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

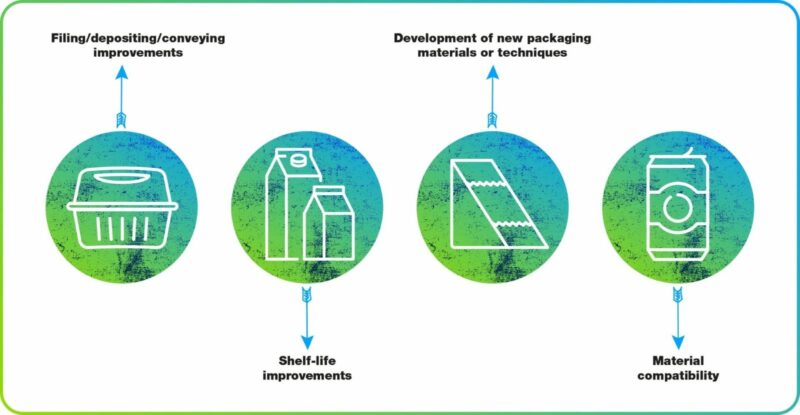

A broad range of engineering projects can meet the Government’s R&D definition, for example:

MANUFACTURING FOOD

PACKAGING

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN THE FOOD & BEVERAGE INDUSTRY?

We speak to so many businesses that don’t feel like they qualify for relief. They think they’re “simply doing their day job”. We think the name ‘Research & Development’ is misleading. It makes people think of lab coats, test tubes, innovation centres.

In reality, R&D pretty much comes down to two qualifying criteria: 1) you’ve made some changes/improvements to your product or manufacturing process; and 2) these changes weren’t obvious or easy and you didn’t know exactly how to make them work from the off.

So, have you ever improved a product? Have you developed one further? Changing ingredients to improve the nutrition of a product could qualify too. And if you’ve made improvements and could quite easily say, “those changes took some thought, some time, and some testing,” it’s time for you to consider your eligibility to claim R&D incentives’

WHY COOPER PARRY?

In three years we’ve put more than £61 million back with businesses. We’ve obtained in excess of £3 million for companies that had already claimed. And we’re a member of the government’s Research and Development Consultative Committee,

Our experience and dedicated R&D incentives specialists means we know what to look for and we know where to find it.

Let’s talk today

Want us to call you? Let’s start a conversation!

Get in touch with Rebecca Prince

Latest News

Reviews

ROBERT, DEC 24

“Prompt service.”

JACK, DEC 24

“Clear and concise advice from Candice. 5 Stars!”

JACK, DEC 24

“Great clear concise service.”

JUDITH, DEC 24

“Efficient, friendly service “

LIZ, DEC 24

“Although new clients to Cooper Parry therefore the audit took longer than we would like, Tara, Steph and their team have been very good in onboarding us and guiding us through it. Communication has been good between us and CP, and we have now worked out a schedule for the 2024 accounts audit which should mean it will be completed earlier.”

CHRIS, DEC 24

“Good team, very responsive.”

PHIL, DEC 24

“Pragmatic on audit approach, supportive on working through technical areas and overall managed to achieve the deadline. Areas of improvement would be communication to ensure we are all aligned on work requirements, deadlines to work around holidays etc. and where each entity is up to in the audit process so we feel assured we are on track.”

HETAL, DEC 24

“The audit was well run with a pragmatic approach where needed. The presentation of the results was also well managed. “

JAMES, DEC 24

“Regarding the audit process, we found no specific areas requiring improvement. Throughout the audit, the regular calls and discussions proved highly productive, with responses that were clear, concise, and any queries were resolved promptly. There was continuity within the team with Steph and Hannah who were approachable. There were no instances of duplicated information that would necessitate additional work to be undertaken. Completed by the Plan Secretary on behalf of / with collaboration from the Trustee. “

PETE, DEC 24

“Very quick and efficient in responses and extremely effective in dealing we have had so far.”