ENGINEERING

Engineering industries continue to advance their existing engineering techniques and this lends itself to R&D tax reliefs.

If you operate an engineering business and you’ve recently developed new or improved products or processes, then there is a strong chance that you could benefit from a Research and Development (R&D) Tax Credit claim.

Full of exciting innovation, UK Engineering is becoming ever-more competitive as projects are becoming more and more complex and the need for increased efficiency and adapting to change are more important than ever.

Investing in R&D can help pave the way in creating new things or improve existing ones by looking at ways in which you can claim up to 33.35% cashback on qualifying R&D spend.

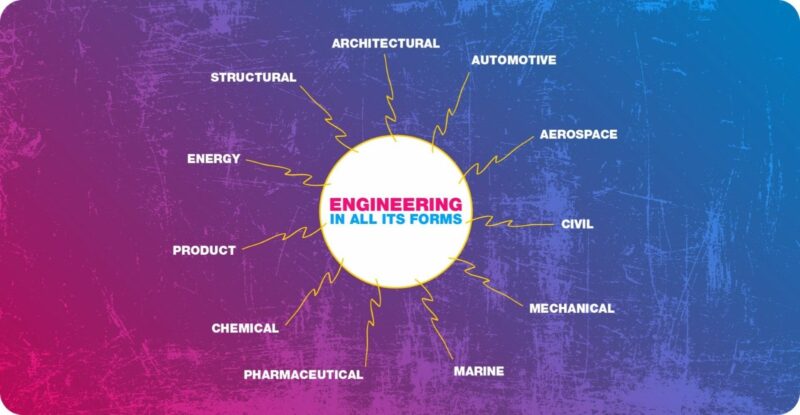

ENGINEERING SECTORS

R&D TAX CREDITS FOR ENGINEERING EXPLAINED

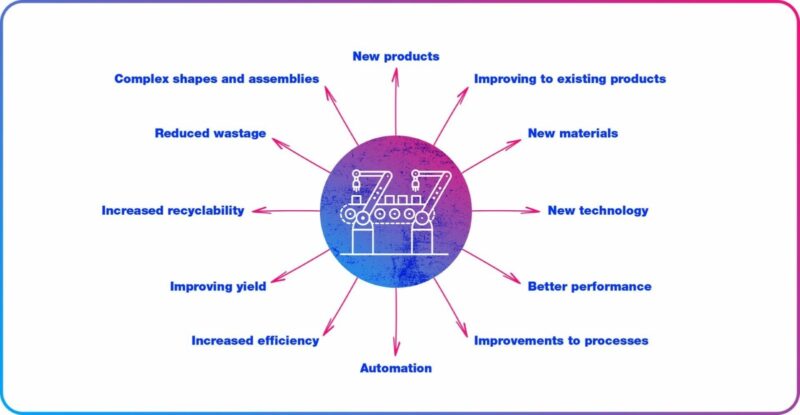

R&D can relate to the development of products or processes. It’s inevitable that all engineering sectors continue to advance their existing engineering techniques. And if this advancement involves a level of head-scratching and problem solving to overcome a series of technical difficulties (as it often does), it’s likely that the project will qualify for R&D incentives.

WHAT TYPE OF ENGINEERING PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

A broad range of engineering projects can meet the Government’s R&D definition, for example:

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN ENGINEERING INDUSTRIES?

We’ve spoken to hundreds of engineering businesses that think they don’t qualify for the relief, which makes the eureka moment all the sweeter.

That’s because R&D boils down to two qualifying criteria. Firstly, have you made a change or an improvement to a product or your engineering process? And secondly, did those changes take some time, some thought or some testing? Maybe there were changes made during the physical and digital design work stage? Or during the computer modeling stage.

If you can answer “yes” to both of those questions, it’s time for us to have a chat, because R&D tax incentives are a fantastic way to keep your business and your cash flow on the front foot.

WHY COOPER PARRY?

In three years we’ve put more than £61 million back with businesses. We’ve obtained in excess of £3 million for companies that had already claimed. And we’re a member of the government’s Research and Development Consultative Committee,

Our Research and Development Partner, Chris Knott CTA BEng, is a dedicated R&D incentives engineer specialist who used to work in the engineering industry. To get the report right and justify the incentives, we need to understand what you’re doing from 1) a technical perspective, and 2) who’s doing what and why it matters. So, you absolutely need to work with advisers with technical backgrounds. It means when we come to see you and have a look around your business, we can poke around in all the dirty corners. We know where to look.

WORDS FROM TRANSVAC

“We’ve worked with Cooper Parry for many years and we’ve always had a good relationship with them. The R&D arm within Cooper Parry has changed, for the better, giving us even further benefit from the tax credits perspective, and giving us improved knowledge that we can apply going forward. The transparency and willingness to share information has been great.

We received improved tax credits for two years’ worth of information provided, once the team’s expert knowledge had been applied – money that we’ll be putting back into R&D. The reports provided were concise and professional. We’d definitely recommend Cooper Parry.” – Transvac

Let’s talk today

Want us to call you? Let’s start a conversation!

Get in touch with Chris Knott

Latest News

Reviews

ROBERT, DEC 24

“Prompt service.”

JACK, DEC 24

“Clear and concise advice from Candice. 5 Stars!”

JACK, DEC 24

“Great clear concise service.”

JUDITH, DEC 24

“Efficient, friendly service “

LIZ, DEC 24

“Although new clients to Cooper Parry therefore the audit took longer than we would like, Tara, Steph and their team have been very good in onboarding us and guiding us through it. Communication has been good between us and CP, and we have now worked out a schedule for the 2024 accounts audit which should mean it will be completed earlier.”

CHRIS, DEC 24

“Good team, very responsive.”

PHIL, DEC 24

“Pragmatic on audit approach, supportive on working through technical areas and overall managed to achieve the deadline. Areas of improvement would be communication to ensure we are all aligned on work requirements, deadlines to work around holidays etc. and where each entity is up to in the audit process so we feel assured we are on track.”

HETAL, DEC 24

“The audit was well run with a pragmatic approach where needed. The presentation of the results was also well managed. “

JAMES, DEC 24

“Regarding the audit process, we found no specific areas requiring improvement. Throughout the audit, the regular calls and discussions proved highly productive, with responses that were clear, concise, and any queries were resolved promptly. There was continuity within the team with Steph and Hannah who were approachable. There were no instances of duplicated information that would necessitate additional work to be undertaken. Completed by the Plan Secretary on behalf of / with collaboration from the Trustee. “

PETE, DEC 24

“Very quick and efficient in responses and extremely effective in dealing we have had so far.”