The National R&D Statistics are published each year for the previous tax year and so we recently had the 22-23 stats released. It was one of the most interesting sets for years, as it was the first set that reflected some of the increased compliance checking activity from HMRC.

Overall, on the face of it, nothing particularly moved in the amounts claimed. Total R&D relief claimed reached £7.5bn (+1%) and the total R&D spend increased +4% to £46.7bn.

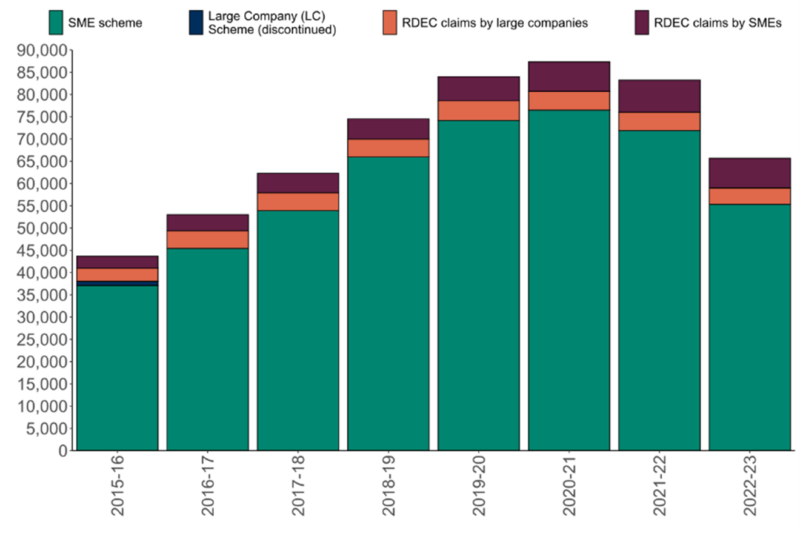

The insightful elements came in the actual number of claims and in the split between Large (RDEC) and SME claims.

RDEC total claims value increased +7% BUT the number of claims reduced by -9%.

SME total claims value deceased by -3% BUT the number of claims has reduced by a staggering -23%!

These figures are further backed up by confirmation that there has been an increase in claims >£250k and an above average reduction in the number of claims <£15,000. With the big clear-out at the lower end of the market, the average claim value went up by a massive +28%.

Figure 1: R&D claims by incentive scheme

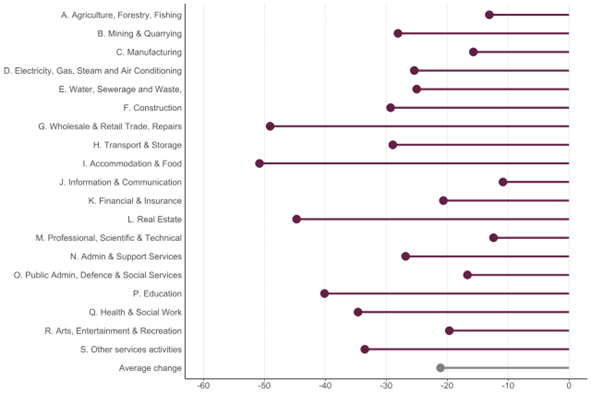

There are also some points of note in the “industry sector” analysis, with huge reductions (-30% and greater!) in sectors that should rarely (if ever) have seen any claims at all, such as: “accommodation” (over -50%), “wholesale and retail trade, repairs”, “real estate” and “education”. EVERY industry sector saw a reduction of at least -10%.

Figure 2: R&D claims by industry sector, % year-on-year change (21-22 to 22-23)

For me, this all points to the measures employed by HMRC in combating error and fraud (increased compliance checks and the introduction of the Additional Information Form – the online/digital forced submission of claim details) are having the desired effect.

The most noise around claims being made for the industries less likely to be R&D qualifying (per Figure 2) has been around the utilisation of a “volume play” bombardment, relying on the lower value of these claims flying under the radar of an under-resourced HMRC. It worked for years but both Figures 1 and 2 suggest this is now being addressed, both in terms of overall volume and in what industries.

I do wonder (as I’ve advocated many times) if simply putting a de minimis limit back in place (like, say, £50k of qualifying spend) would have saved a lot of the time and effort for HMRC in reducing the amount of lower value claims being submitted and the pain of the compliance checks for some of the larger claimants who have been put through them, lasting many months, with genuine claims (acknowledged by HMRC as “collateral damage”) but have ended up giving up (through time or cost constraints).

It would be easy enough to put some additional fairly straightforward rules in place for start-ups so that they’re not caught by the de minimis and hence not stifling the growth funding of those companies.

So, what next? Well, we await the Budget at the end of the month with bated breath as to the new Government’s view on R&D incentives and their plans for them. Hopefully, despite some of the negative press over recent months, the Statistics provide some much needed reassurance that the policing of the scheme is improving and that the overall upside for companies has remained the same. A step towards quality over quantity perhaps.

A period of stability is what’s actually needed, with no further major changes to rules and commencement dates thereof, to allow both claimants and advisors alike to know exactly what they’re playing with and inform their decisions accordingly.

If you want to discuss any of the above, get in touch.